Recently, DEMETER ICT, in collaboration with Shopify, hosted an online seminar titled “Winning with Brand.com & Marketplaces,” which can be translated into Chinese as “以品牌官网与电商平台制胜市场.”

Shopify is a leading global e-commerce website platform, currently serving over 4.6 million online stores across 175 countries. Many world-renowned brands such as CHANEL, Nike, and Nestlé trust Shopify as the core technology platform for their e-commerce operations.

The online seminar featured two keynote speakers:

Dr. Varanyu Suchivoraphanpong, Founder and CEO of DEMETER ICT

Soojin Jeong, Senior Partnership Manager at Shopify

Together, the speakers shared insights and practical experiences on the trends and strategies behind the synergistic growth between brand-owned websites (Brand.com) and e-commerce marketplaces.

In-depth Analysis of Southeast Asian Online Shopping Behavior — An Exclusive Interview with Dr. Varanyu

Summary of Core Findings, Trends, and Conclusions

In 2023, the total transaction value of the Southeast Asian e-commerce market reached USD 114.6 billion. Shopee maintained its position as the regional leader, followed by Lazada in second place. Meanwhile, TikTok Shop experienced a rapid surge with an annual growth rate exceeding 200%, and it is expected to become the second-largest platform in the region by 2024. Indonesia remains the largest single market, accounting for nearly half of the region’s total value.

Data Sources, Coverage, and Methodology

This report is based on data from Momentum Works’ “Ecommerce in Southeast Asia 2024”, supplemented by public financial statements, platform traffic statistics, and market interviews. The analysis covers six major markets: Thailand, Indonesia, Vietnam, Malaysia, Singapore, and the Philippines.

Overall Market Performance

| Indicator | Data | Description |

|---|---|---|

| Total E-commerce GMV in Southeast Asia | US$114.6B | Year-on-year growth of approximately 18% |

| Main Growth Drivers | Indonesia, Thailand, Vietnam | Growth driven by social commerce |

| Market Concentration | Top 3 platforms account for 80%+ | Shopee, Lazada, TikTok Shop |

Insight: Market competition is becoming increasingly concentrated, while content-driven commerce and live-stream shopping have emerged as the main growth engines.

Country Insights

🇹🇭 Thailand

GMV: USD 19.3 billion

Platform Share: Shopee 49% | Lazada 30% | TikTok Shop 21%

Trend Analysis: TikTok Shop has become a strong third player, growing more than threefold. Many brands have started investing in their own Brand.com websites.

🇮🇩 Indonesia

GMV: USD 53.8 billion (largest in the region)

Platform Share: Shopee 40% | Tokopedia 30% | TikTok Shop 11%

Trend Analysis: Following the merger of Tokopedia and TikTok Shop, the combined entity is expected to become the second-largest platform in 2024.

🇲🇾 Malaysia

GMV: USD 9.6 billion

Platform Share: Shopee 63% | Lazada 19% | TikTok Shop 19%

Insight: TikTok Shop is catching up rapidly with Lazada. Both advertising investment and live-commerce penetration are rising quickly.

(The same pattern can be applied for the Philippines, Vietnam, and Singapore.)

Platform Landscape

| Platform | Regional GMV (USD billions) | Share | Growth Trend |

|---|---|---|---|

| Shopee | 55.1 | 48% | Steady growth |

| Lazada | 18.8 | 16% | Slowing growth |

| Tokopedia | 16.3 | 14% | Undergoing merger |

| TikTok Shop | 16.3 | 14% | Rapid growth |

| Others (Bukalapak, Blibli, etc.) | 8.2 | 7% |

Insight Summary:

Trends & OutlookTrend 1: Continued Expansion of Content-driven Commerce Trend 2: Significant Growth in Cross-border E-commerce Trend 3: AI and Personalization as the Next Growth Drivers The Importance of Dual Channels: Brand.com and Marketplaces — Insights from SoojinDuring the seminar, Soojin Jeong shared several key data points explaining why businesses must operate both a Brand.com website and marketplaces simultaneously. According to YouGov survey data, over 86% of Southeast Asian online shoppers purchase from both channels — Brand.com and marketplaces. A deeper look into the reasons behind consumer purchasing behavior reveals the following:

These insights clearly demonstrate that to meet the diverse needs of consumers, businesses must develop both their own Brand.com and presence on major marketplaces — ensuring a balance between brand trust and price competitiveness.  According to the data above, if a business successfully builds a well-known or popular brand, consumers are more likely to purchase directly through the brand’s official website (Brand.com). In addition, the average basket size (order value) on Brand.com is typically higher. Research shows that over 83% of consumers visit a brand’s website to learn about products before making a final purchase decision, whether they ultimately order through the brand’s own website or its store on a marketplace. From Shopify’s own merchant base (brands operating both Brand.com and marketplaces), it has been observed that:

According to YouGov survey results, brands identify two key advantages of owning a Brand.com:

Meanwhile, the two main advantages of selling on marketplaces are:

Based on Shopify’s experience serving various businesses, the company summarized four key strategies for driving online growth:

When comparing the Customer Journey between Brand.com and marketplaces:

On marketplaces, brands cannot fully customize the shopping journey and do not have direct access to customer data, as all customer information is controlled by the platform.

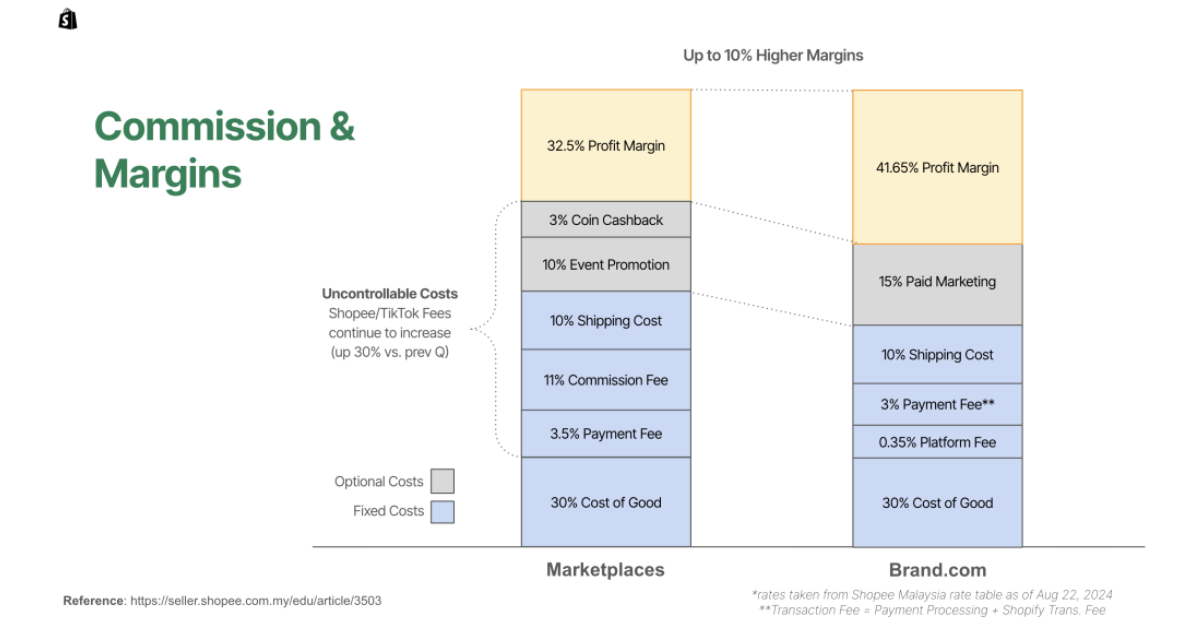

In terms of profit margins, data shows that:

The main reason for this gap is that marketplaces typically charge around 11% in sales commission fees, which increases overall costs and reduces profitability. In conclusion, a Brand.com website not only strengthens trust and data ownership but also enhances profitability and customer lifetime value (LTV).  Based on the information above, if a business or brand wishes to succeed in online channels, it must develop a sales strategy tailored to its customers’ specific characteristics. In the initial stage, brands can start by setting up a simple online store on marketplaces to quickly enter the market and test consumer response. After that, businesses should gradually guide customers to make purchases through their Brand.com site, allowing them to gain direct access to customer data and thereby develop long-term customer relationships and loyalty programs. Note:  About the author Find out more todayDEMETER ICT - No. 1 Zendesk Premier Partner in Asia Pacific and Great China Region.

Your Business Transformation Partner

Headquarter: |